Are you wondering if your social security benefits are taxable? Understanding how social security benefits are taxed can be confusing. It’s important to know how to calculate your taxable income accurately to avoid any surprises come tax time.

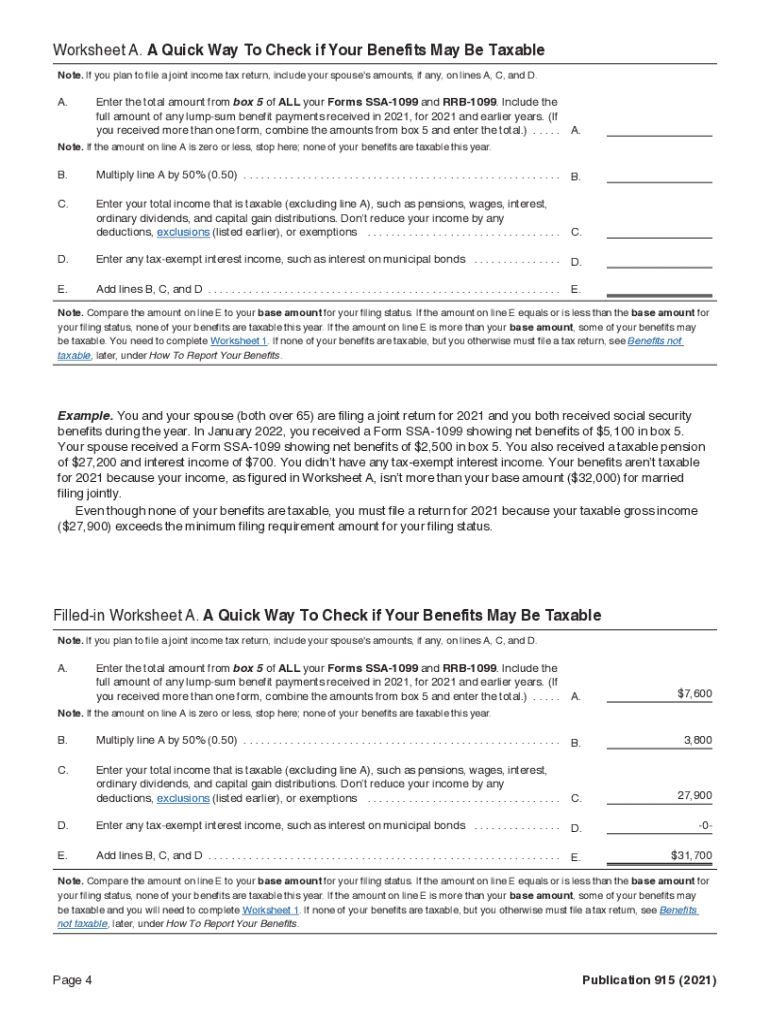

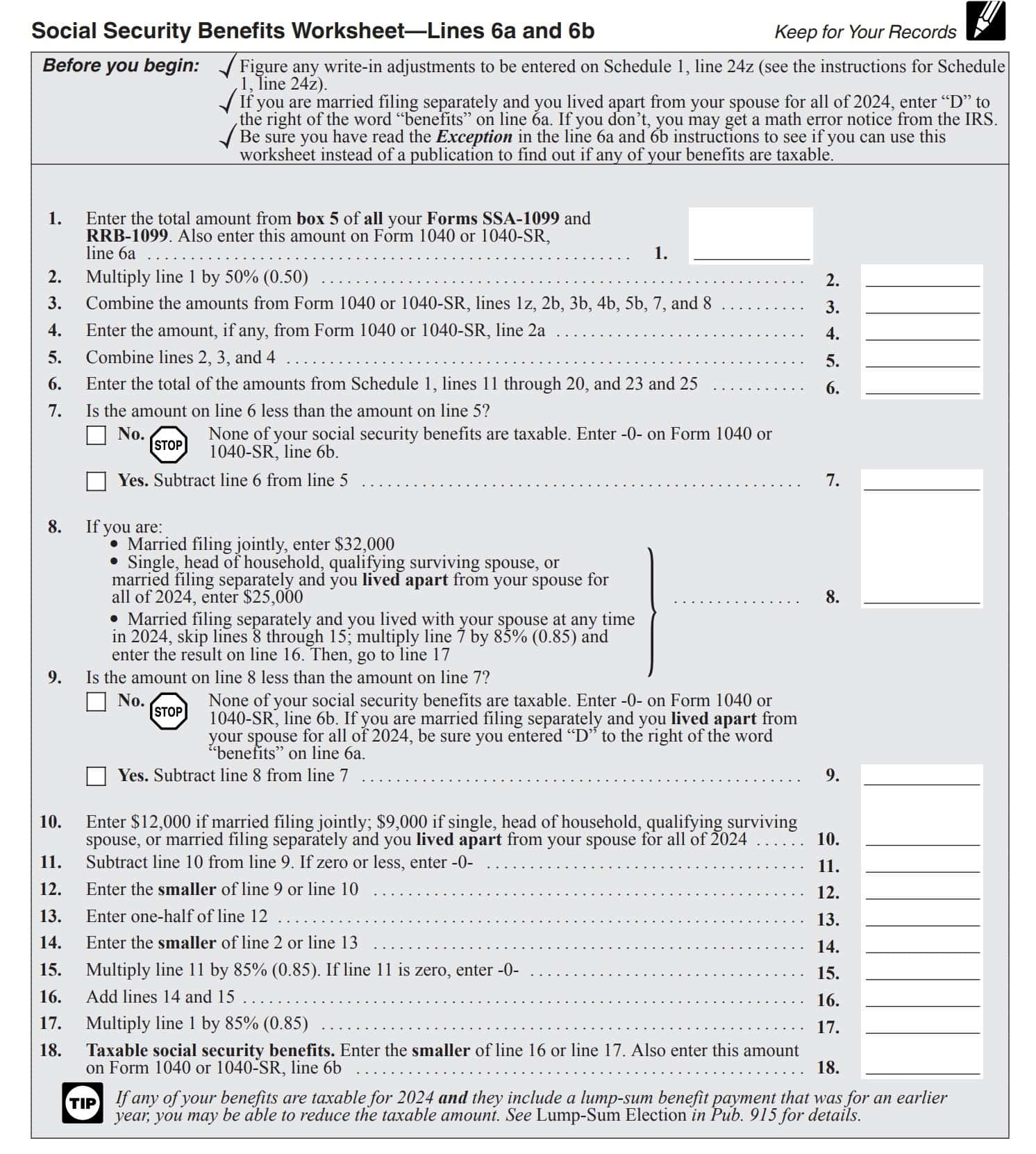

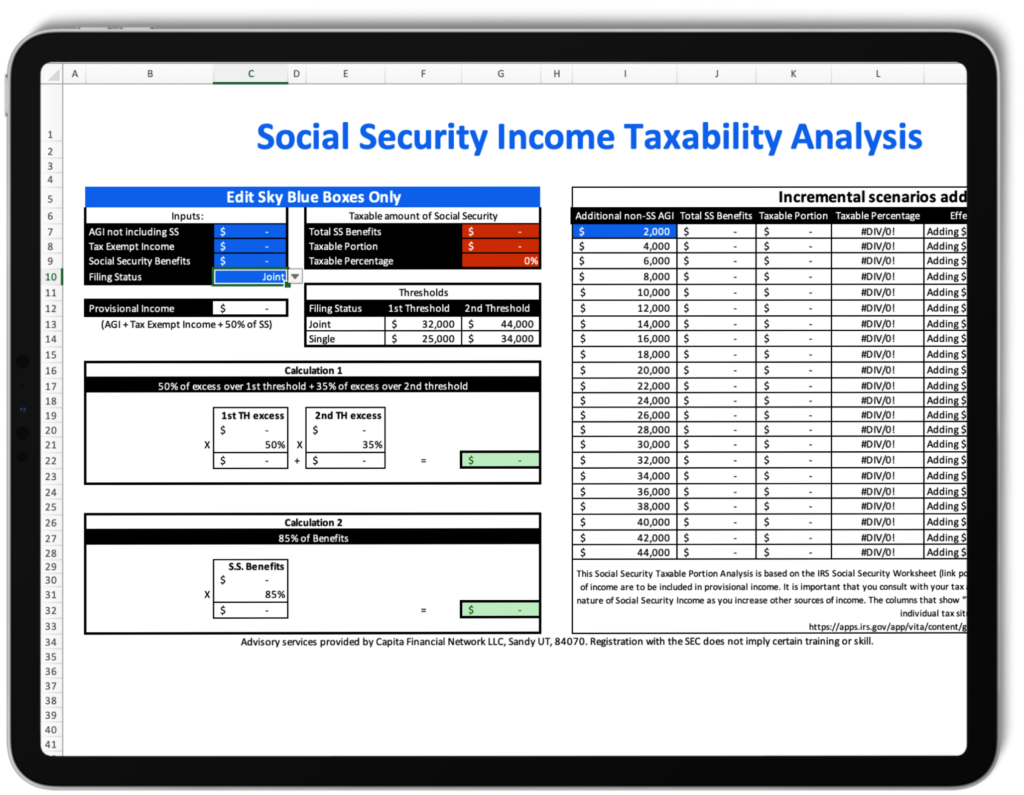

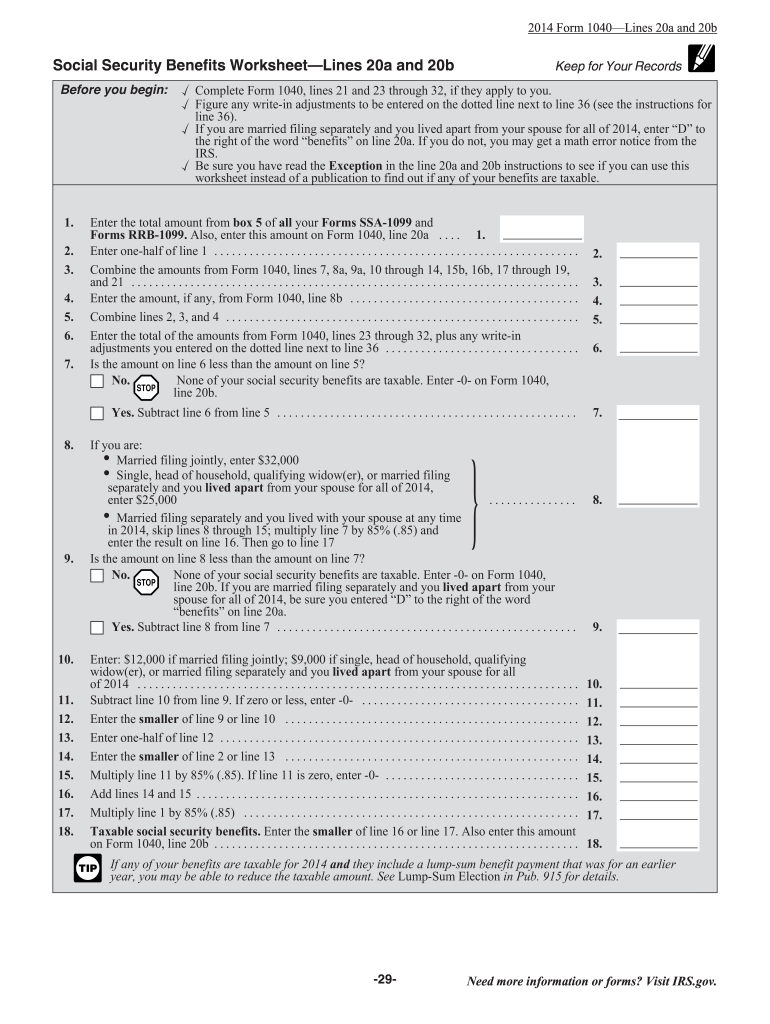

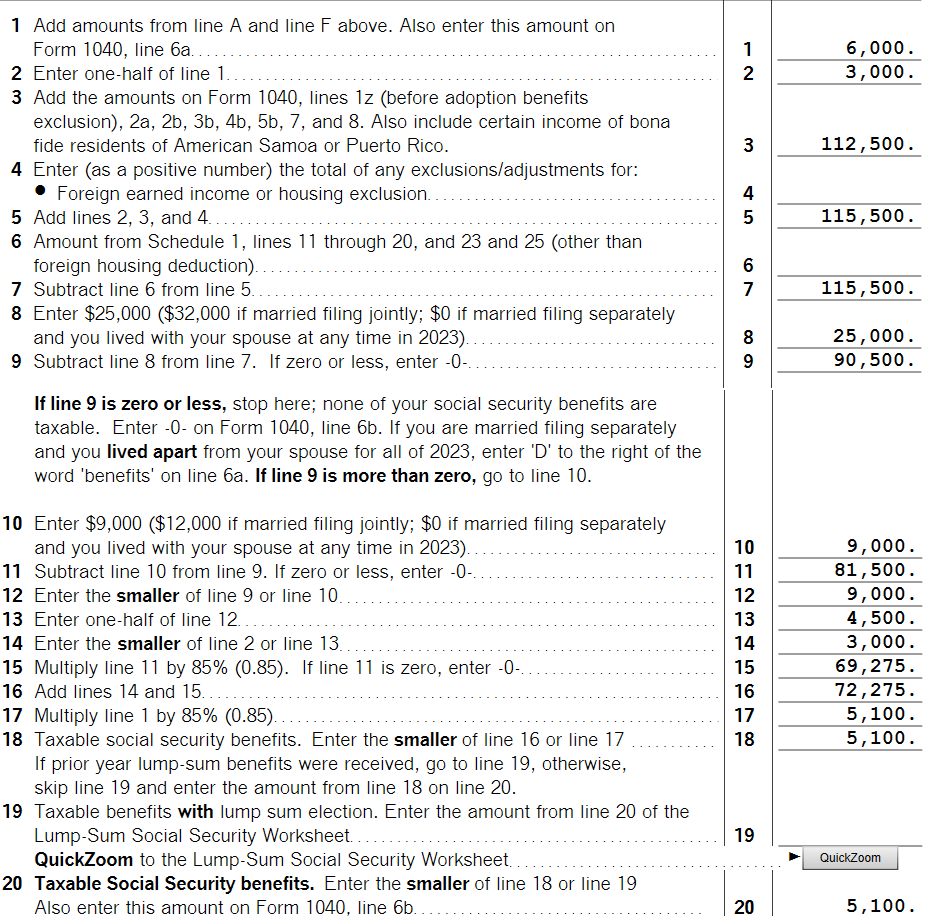

One tool that can help you determine if your social security benefits are taxable is the social security taxable income worksheet. This worksheet allows you to calculate the amount of your benefits that may be subject to federal income tax.

social security taxable income worksheet

Using the Social Security Taxable Income Worksheet

The social security taxable income worksheet takes into account your filing status, total income, and half of your social security benefits. By following the instructions on the worksheet, you can determine if any portion of your benefits is taxable.

If your total income exceeds a certain threshold, a portion of your social security benefits may be subject to federal income tax. The worksheet helps you calculate this amount based on your specific financial situation.

It’s essential to fill out the social security taxable income worksheet accurately to ensure you’re paying the correct amount of taxes on your benefits. By following the instructions carefully, you can avoid any potential tax errors and make sure you’re compliant with IRS regulations.

Understanding how social security benefits are taxed can help you better plan for your financial future. By using tools like the social security taxable income worksheet, you can stay informed and make informed decisions about your retirement income.

Form SSA 1099 Instructions Social Security Benefits

Social Security Worksheet The Retirement Nerds

Social Security Worksheet Pdf Fill Out Sign Online DocHub

Solved Taxable Social Security Worksheet