Are you looking to better understand qualified dividends and capital gains taxes? It can be a confusing topic, but don’t worry, we’re here to help break it down for you.

When it comes to taxes on investments, qualified dividends and capital gains are taxed at a lower rate than ordinary income. This can be a significant benefit for investors looking to minimize their tax liabilities.

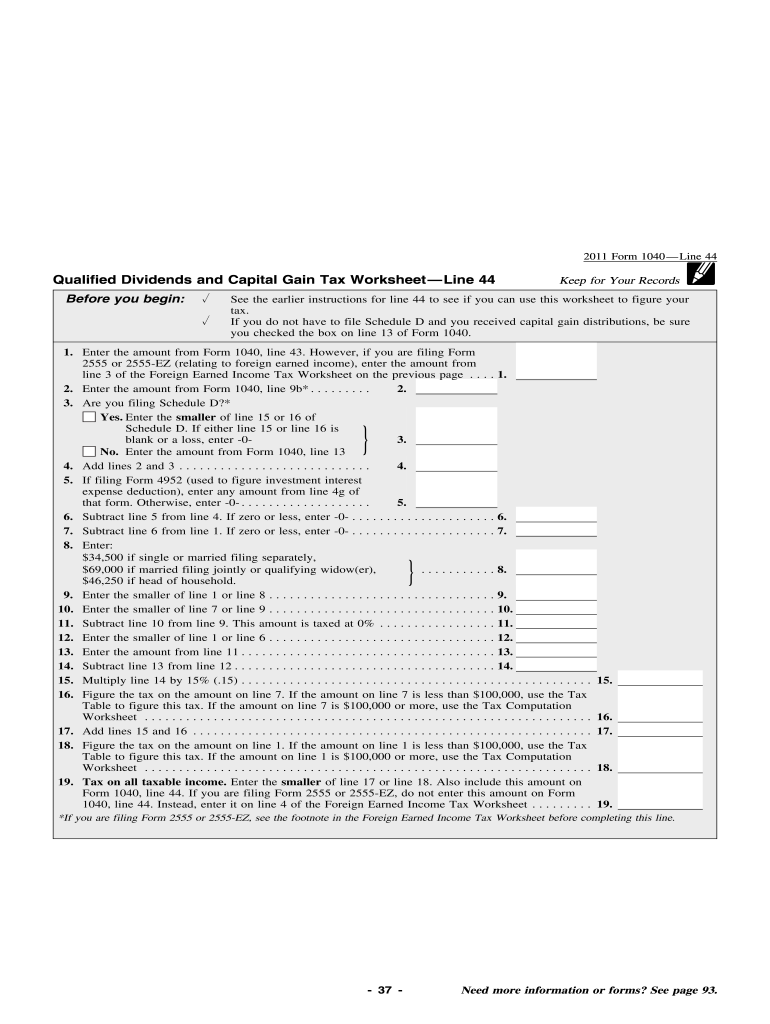

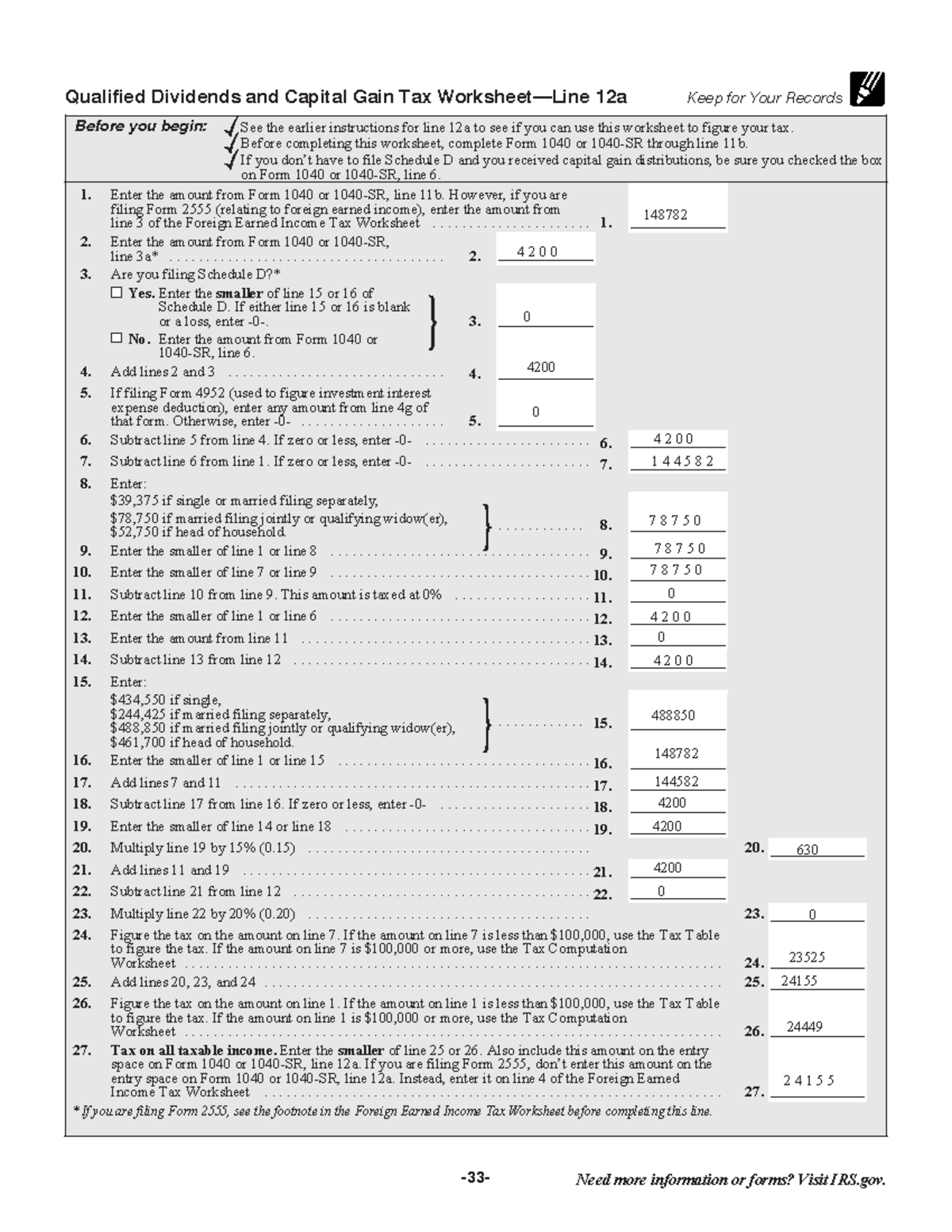

qualified dividends capital gain tax worksheet

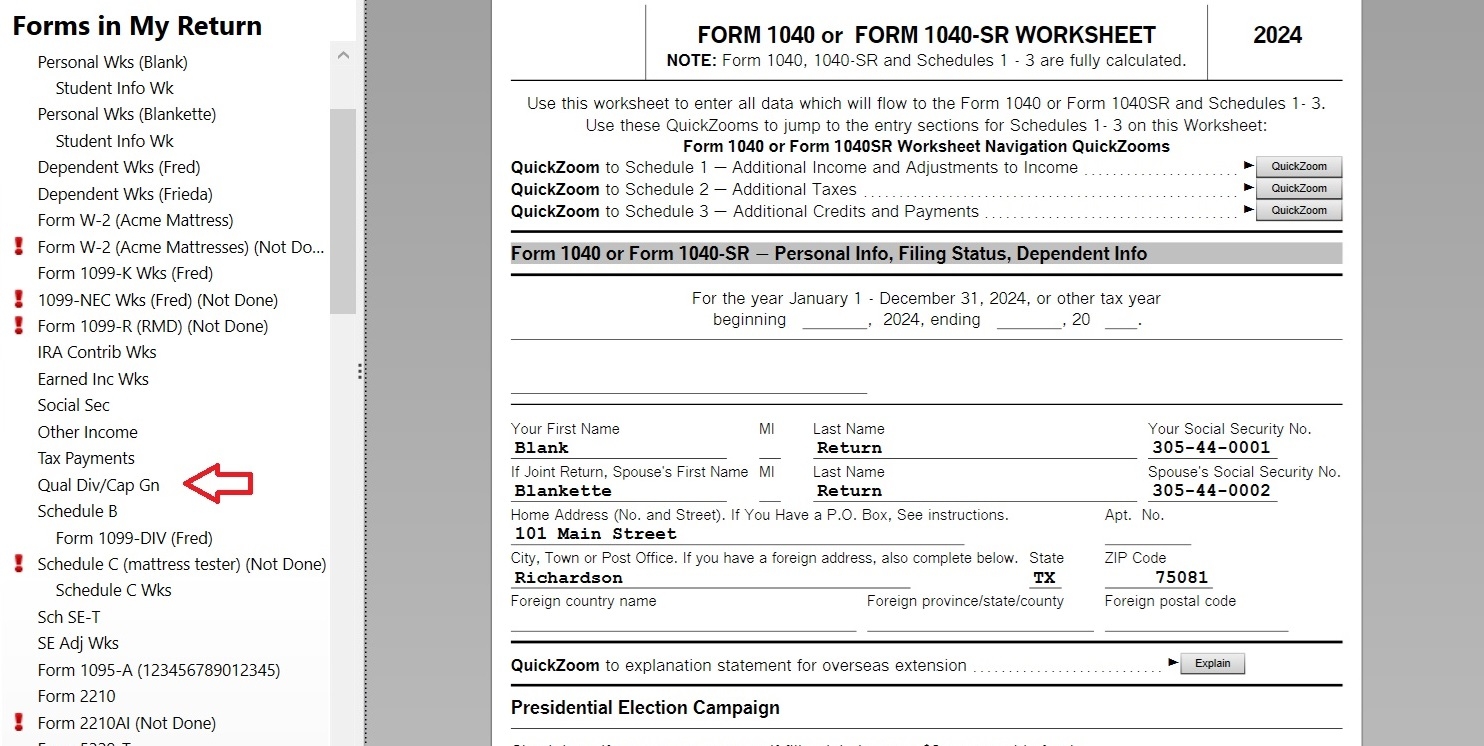

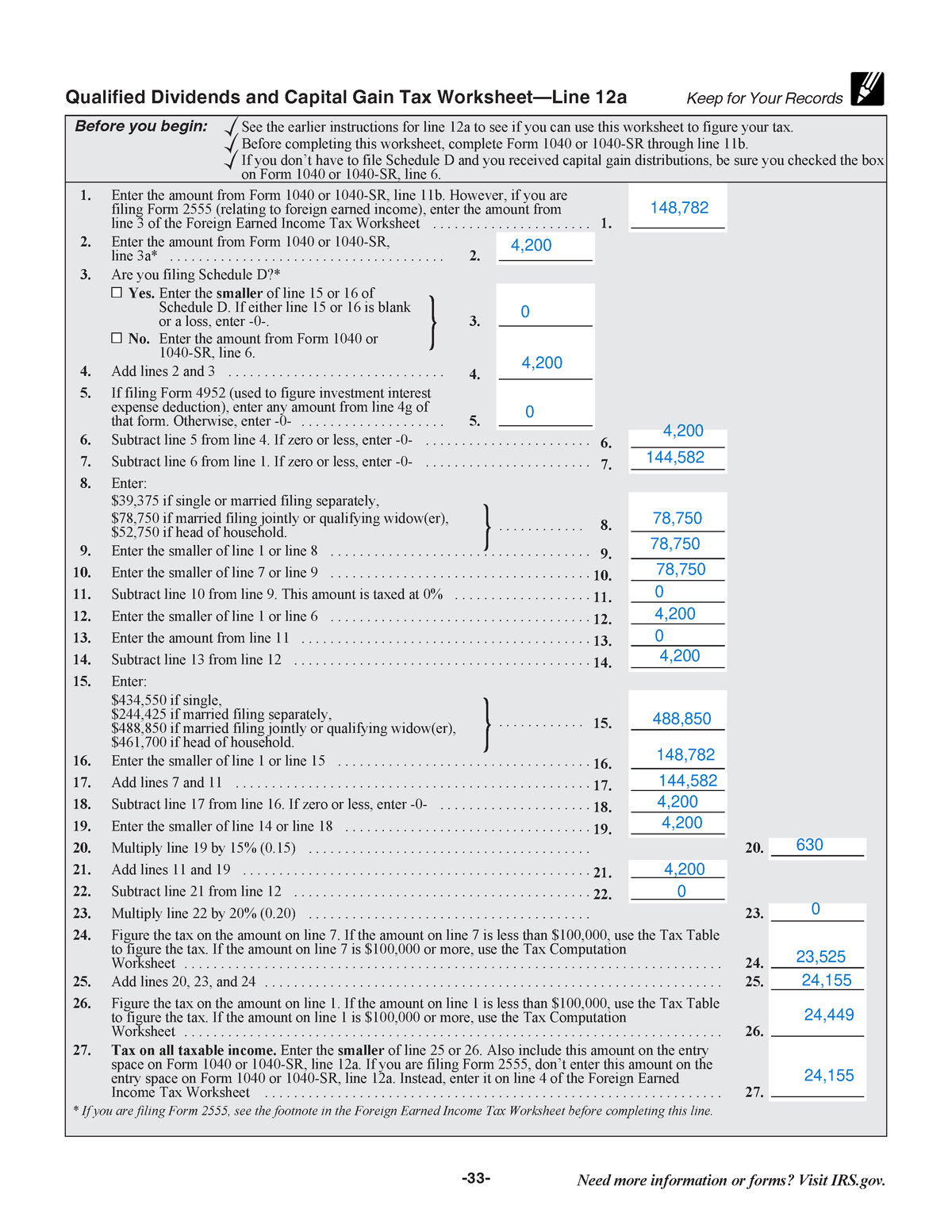

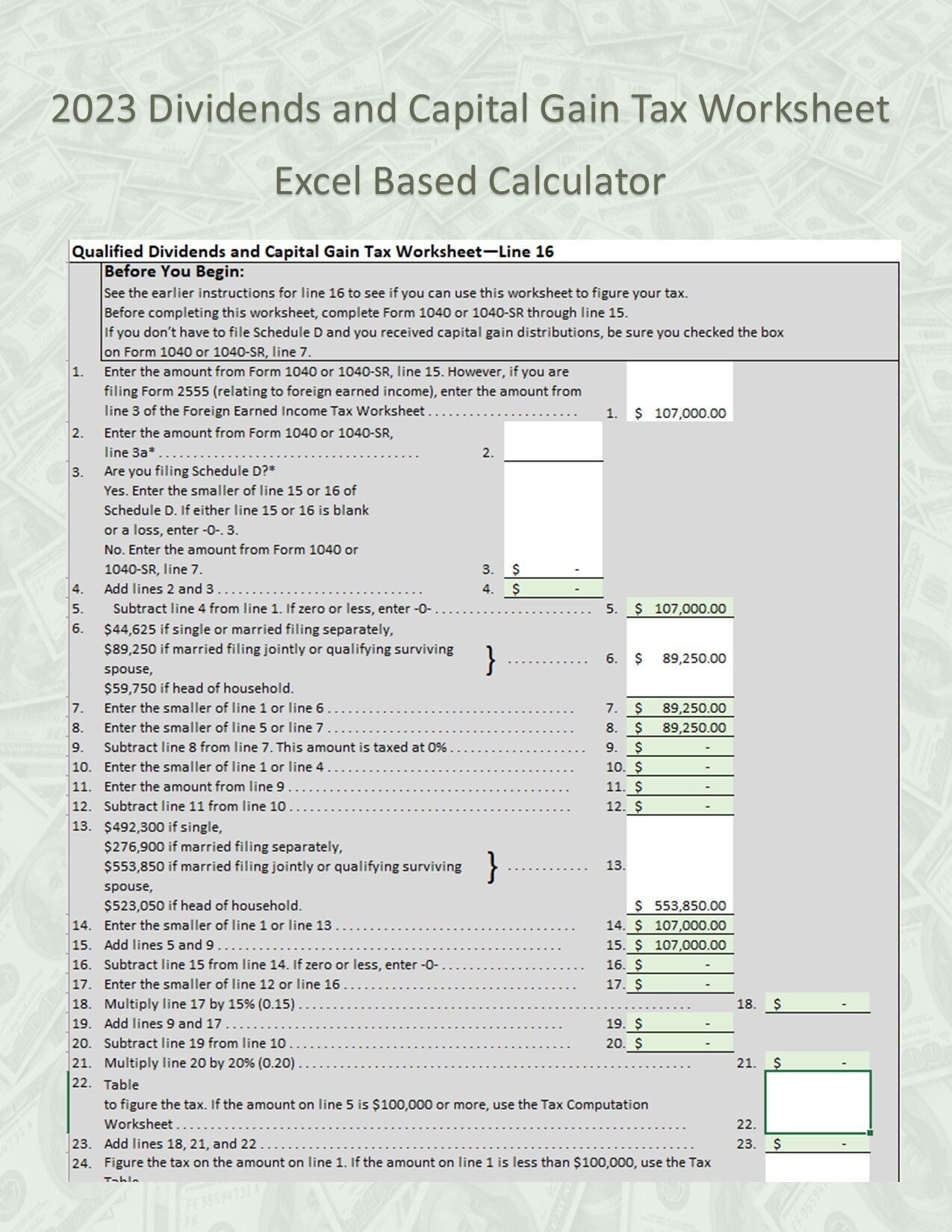

Understanding the Qualified Dividends Capital Gain Tax Worksheet

The Qualified Dividends and Capital Gain Tax Worksheet is a tool provided by the IRS to help taxpayers calculate their tax liability on these types of investment income. It takes into account various factors, such as filing status and total income, to determine the appropriate tax rate.

By using this worksheet, investors can ensure they are paying the correct amount of tax on their qualified dividends and capital gains. This can help avoid any potential issues with the IRS and ensure compliance with tax laws.

It’s important to note that the tax rates for qualified dividends and capital gains can vary depending on your income level and filing status. By utilizing the Qualified Dividends and Capital Gain Tax Worksheet, you can accurately determine your tax liability and make any necessary adjustments to your investment strategy.

In conclusion, understanding how qualified dividends and capital gains are taxed is essential for investors looking to maximize their returns while minimizing their tax burden. By using tools like the Qualified Dividends and Capital Gain Tax Worksheet, you can ensure you are meeting your tax obligations and making informed investment decisions.

Solved Qualified Dividends And Capital Gain Tax Worksheet Missing

Qualified Dividends And Capital Gains Worksheet Page 33 Of 108 Worksheets Library

Easy Custom Calculator For 2023 Qualified Dividends And Capital Gain Tax Worksheet excel 2016 Also Includes Tax Computation Worksheet Etsy

Qualified Dividends Capital Gains Tax Worksheet Form 1040 Line 12a Studocu