Are you self-employed and looking for a simple way to track your business expenses? Using a Schedule C expenses worksheet can help you stay organized and save time when tax season rolls around. By keeping detailed records of your expenses, you can ensure that you are maximizing your deductions and minimizing your tax liability.

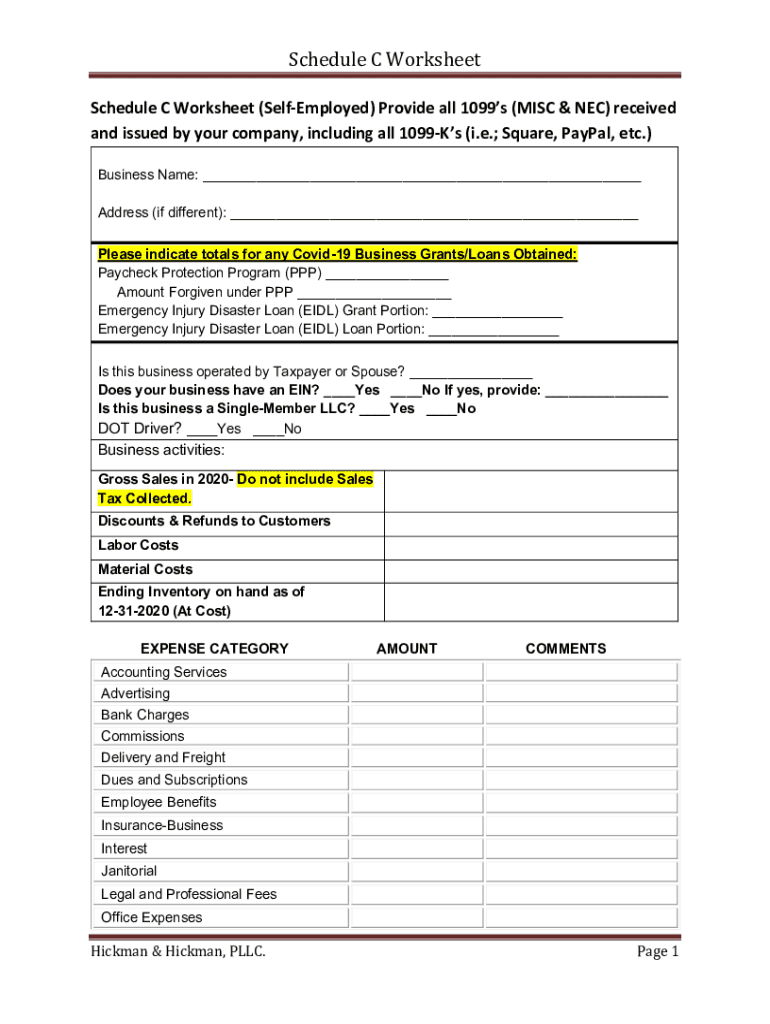

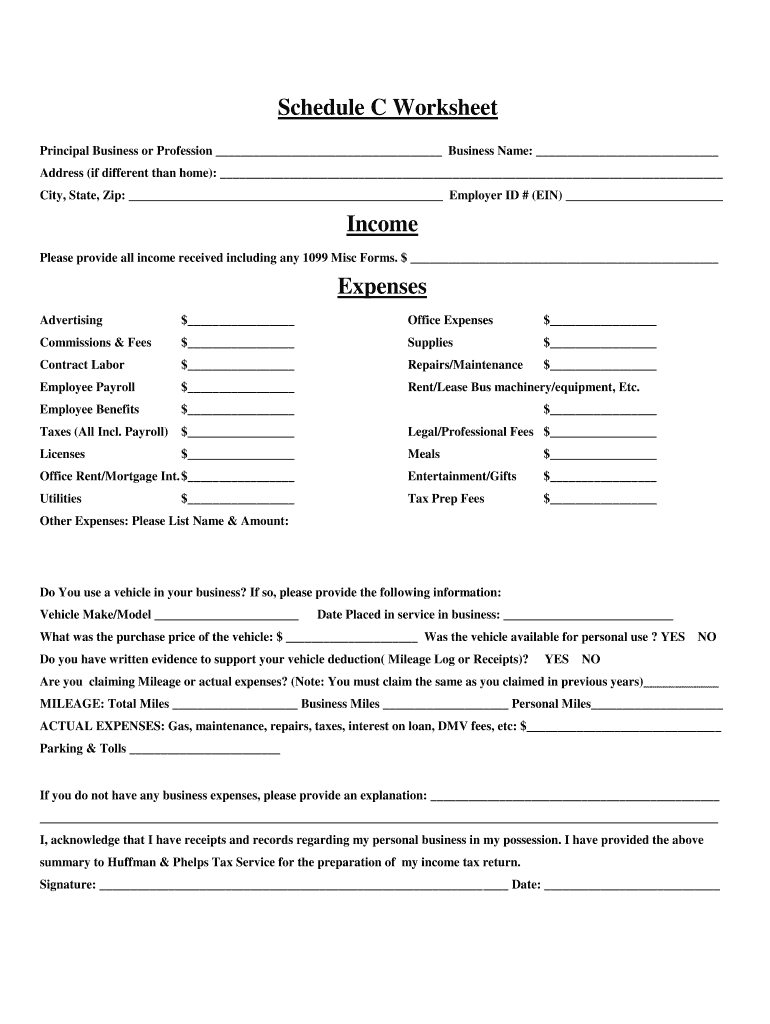

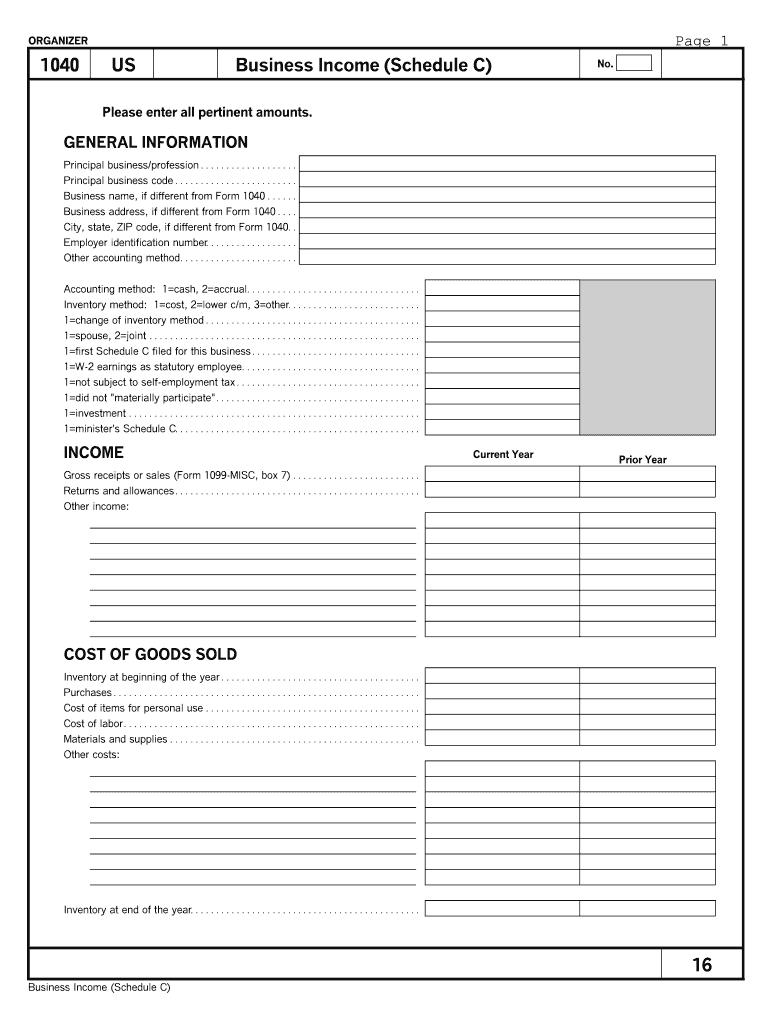

With a schedule C expenses worksheet, you can easily categorize your expenses and keep track of receipts and invoices. This can be especially helpful if you have multiple sources of income or if you work from home. By using a worksheet, you can ensure that you are claiming all eligible expenses and avoiding any potential audits.

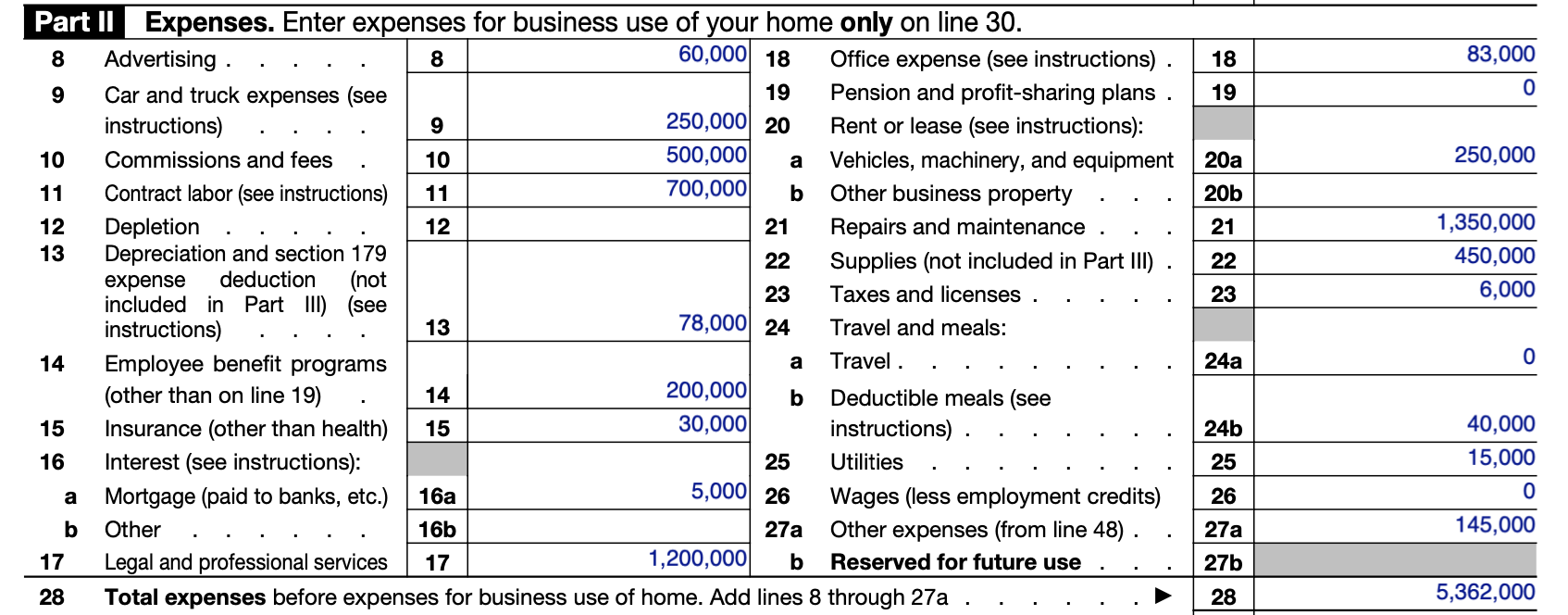

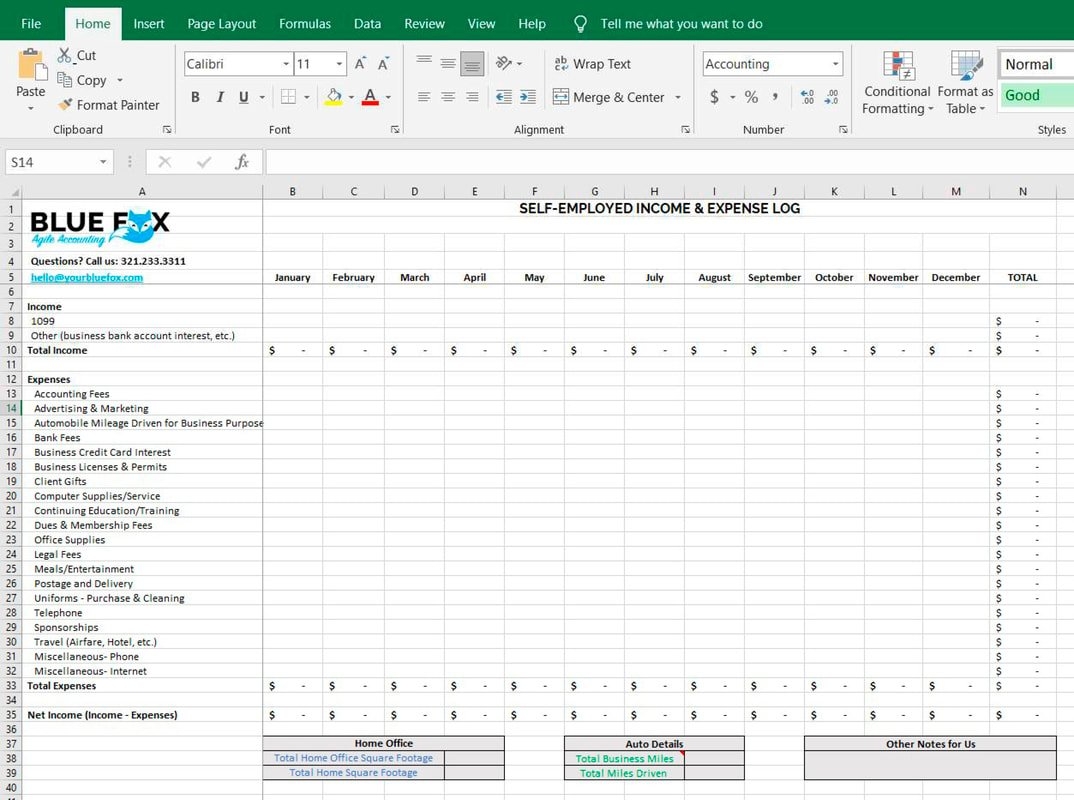

schedule c expenses worksheet

The Benefits of Using a Schedule C Expenses Worksheet

One of the main benefits of using a schedule C expenses worksheet is that it can help you save time and stay organized. By recording your expenses in one central location, you can easily access the information you need when it comes time to file your taxes. Additionally, using a worksheet can help you identify any potential deductions that you may have overlooked.

Another advantage of using a schedule C expenses worksheet is that it can help you track your spending habits and identify areas where you may be overspending. By keeping a detailed record of your expenses, you can make informed decisions about where you can cut costs and improve your overall financial health.

In conclusion, using a schedule C expenses worksheet is a simple and effective way to track your business expenses and maximize your deductions. By staying organized and keeping detailed records, you can ensure that you are in compliance with IRS regulations and minimize your tax liability. So why not give it a try and see the benefits for yourself?

1099 Schedule C Fill Out Sign Online DocHub

Schedule C Expenses Worksheet Fill Out Sign Online DocHub

Schedule C Expenses Worksheet Fill Out Sign Online DocHub

Free Download Schedule C Excel Worksheet For Sole Proprietors BLUE FOX Accounting For Nonprofits And Social Enterprises